Real Rates of Return

It would be easy to condemn as irresponsible the City Council of Vacaville, California, for their vote last week, granting “3% at 50” benefits to their firefighters. At this point, don’t we all know these are financially unsustainable promises? But on the other hand – isn’t “3% at 50” the standard for municipal firefighter contracts? Shouldn’t these firefighters earn pensions at the same level as their counterparts in other cities? Indeed they should. The real question is this – can Vacaville invest 23% of their firefighter’s salaries into a pension fund each year – Vacaville’s current commitment – and expect it to earn a sufficient amount to fund these upgraded retirement benefits? The answer hinges on what real rate of return their pension funds can expect to earn over the next few decades, and what variables will influence these returns upwards or downwards.

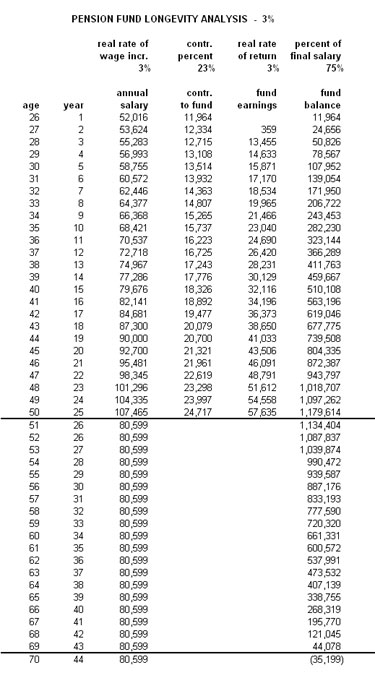

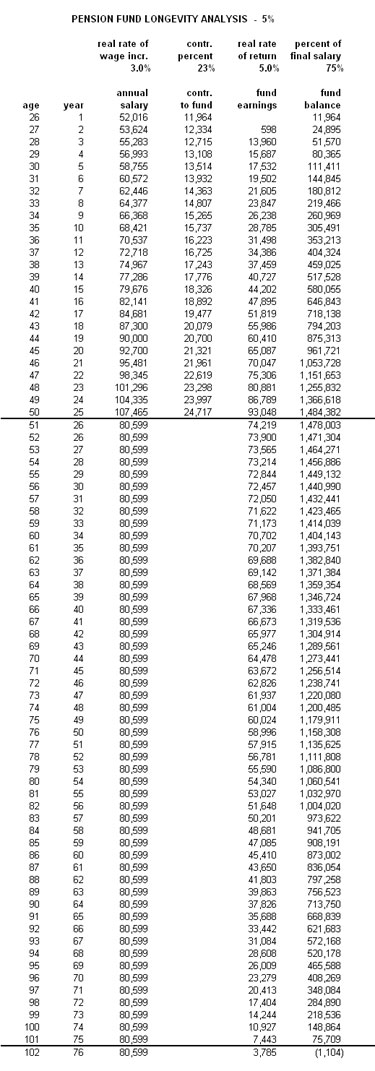

In this analysis, we assume a firefighter retires after 25 years work at age 50, which at 3% per year, would mean this firefighter would collect 75% of their final salary throughout their retirement. At various real rates of return on investment, for how many retirement years would this firefighter have a solvent pension fund? In the tables following this post are three cases which I believe use real rates of return – i.e., adjusted for inflation – that might be reasonably projected over the next few decades, 3%, 4% and 5% per year. Depending on which of these returns you choose, surprisingly different funding scenarios ensue, with dramatically different implications for policy.

At a long-term real rate of 3% annual return on investment, with a 23% of salary fund input per year, and salary of $90K per year reached in year 19 of a 25 year service (3% inflation-adjusted salary increase per year), retiring at age 50, this retiree’s fund will be out of money by the time they reach 70 years of age.

At a real rate of 4% return on investment, under the same assumptions, the retiree’s fund will run out of money by the time they reach 77 years of age. But the pleasant surprise is what happens to these funds if they can yield just one more point per year.

At a real rate of 5% return on investment, under these assumptions, the retiree’s fund will not be out of money until they are 102 years of age. If a 5% return is all it takes, why can’t we provide everyone this level of security? Is it realistic to expect to invest 23% of everyone’s salary each year into their retirement fund? And how much of this 23% (or more) should be deducted from paychecks, instead of kicked in by the employer?

Returning to the question of what annual rate of return should be considered realistic for a pension fund in the long term, a fund as large as the collective public pension funds of state, city and county employees across the USA, cannot be expected to grow at a real rate of return that exceeds that of the economy in which this fund is invested. This is why returns of 8% per year or more, earned when these funds were smaller, and earned during a time of unsustainable broader economic growth, cannot be expected in the future. In order to determine whether or not even a 5% real rate of return is realistic, one must consider the historic rate of growth of the global economy, which was about 2% per year through the eve of the industrial revolution, growing to about 3% per year by the dawn of the 20th century, reaching 3.5% during the first half of the 20th century, and 4.0% during the second half of the 20th century. What is a sustainable rate of future global economic growth?

On one hand, the 4.0% real economic growth of the global economy during the 2nd half of the 20th century was perhaps inflated by the internet bubble and rising levels of debt. But given the dramatic and ongoing leaps in technology we have seen in the past decades, it is nonetheless not unreasonable to assume that today’s long-term rate of real global economic growth is going up, not down. The question is what, other than unwinding excessive debt, will derail global economic growth?

The biggest challenge to global economic growth exceeding 5% per year are environmentalist restrictions on resource development. International lending should not exclude projects that lead to efficient, inexpensive production of energy and water, and this question – how much cost-effective genuine resource development can we fund – is what should inform national and international infrastructure planning. A gravity fed canal from the Volga to the Aral Basin, for example, or a rail link from Alaska to Siberia, or breeder reactors in Texas. National and international wealth are created when the precursers to a prosperous civilization, the public infrastructure necessary for inexpensive delivery of energy, water, transportation and shelter, are built and delivered cost effectively.

The constraints that limit global economic growth are not driven by scarce resources, or technological inadequacy, or due to a prohibitive expense for the requisite infrastructure to deliver an excellent quality of life to virtually anyone on earth. Instead the primary constraints on economic growth are the result of fanatical environmental activists – backed by powerful special interests – who have consistently blocked development projects, and they are more powerful now than ever.

Economic growth and wealth are gained by making public services less expensive, not more expensive. This means the policies governing investments in water, energy, transportation, and land use should emphasize clean burning, cradle-to-cradle cleanliness, but should not go beyond these reasonable safeguards to artificially create prohibitive costs. Environmentalist restrictions on resource development have combined to cripple the USA’s economy, along with much of the rest of the world, and this is the real challenge – overcoming this injustice and tragic folly. Moreover, it is false to believe economic growth causes inevitable environmental harm, because along with refining and upgrading our physical infrastructure, technology-driven future economic growth can continuously and indefinitely be directed into very low-impact, high-value new economic sectors to service a stable, aging, prosperous global population of humans – android caregivers for the elderly, neurologically activated exoskeletons for personal mobility enhancement, space industrialization, life-extension, and planetary remediations of extraordinary scope, to name a few.

In order to achieve real rates of economic growth of 5% or more, year after year, which is necessary before upgraded retirement benefits can be sustainably extended to everyone, political leaders must recognize the importance of encouraging resource development, instead of emphasizing self-serving and punitive surveilance and rationing tactics, higher taxes, fees, carbon “trading” proceeds, and other green extremist policies that require minimal investment but curtail future growth.

Freedom from green extremism is the only way the global economic pie can grow at up to 5% per year, and provide us the wealth to adapt to whatever natural phenomena may come, clean our many footprints, and all know the benefits of global abundance. Reforming environmentalism is crucial to raising real rates of economic growth, and consequently, to raising real rates of return on retirement funds, so we might all live as well in our retirements as the firefighters of Vacaville.

Edward Ring is a contributing editor and senior fellow with the California Policy Center, which he co-founded in 2013 and served as its first president. He is also a senior fellow with the Center for American Greatness, and a regular contributor to the California Globe. His work has appeared in the Los Angeles Times, the Wall Street Journal, the Economist, Forbes, and other media outlets.

To help support more content and policy analysis like this, please click here.

I will be the first to ‘bite’/post on this article. It is a pretty good article, however (isn’t there always a however) real rates of return are difficult to calculate. You have included inflation in your ROR analysis – something a lot of people ‘forget’ to do. Inflation has been manipulated by the fed to hide accurate indexing. Hedonic inflation adjustment was adopted by the fed during the Bush administration to give the impression that inflation was under control. In addition, only certain staple items could be compared (most recently food/energy were left out), to prior years. The manipulation of the inflation index was further increased by the ability to pick years to compare staple sectors to. As an example, instead of comparing electric rates to the prior year, we may compare them to 5 years prior, or 20 years – giving a ‘smoothing’ rate to that sector. Perhaps inflation in that sector has been 10%/year for the last 5 years, but if we compare it to the last 20 years, it may come out to 4%. Why do I bring this up? Next paragraph….

So, figuring real returns can be difficult. The return rates table you have here is great, but there has been a mass of unreported inflation building up that is not calculated in. The unreported infation, combined with the real global devaluation of the dollar (has fallen 40% against major/stable currencies over the last 8 years), as well new as restrictions on business are all setting the stage for hyper inflation (at the consumer level) and high interest rates. The potential effect on the stock markets is huge. While in real terms, companies (as well as individuals) will be losing ground to inflation, hard assets owned by business will balloon, but lose value relative to real worth when compared to staple commodities. Companies will be paying higher dividends, with per share stock valuations heading north pension obligations will be within easy reach. Of course the real value of those obligations will have decreased. Which brings us to who will suffer – the retiree. The retiree, with a (somewhat) fixed pension, will see the buying power of that pension erode faster than ever. In the end analysis, someone has to suffer the decisions of the fed reserve, manipulated inflation numbers, and that person is the retiree.

This is a brilliant article. Unfortunately what has been lost in the environmental debate is the benefits of infrastructure to the population. The debate is always framed by putting environmental concerns above human concerns. They are not mutually exclusive. For instance, roads are one of the most basic and freeing infrastructure investments a Third World country can make, opening new markets, allowing people to travel more conveniently, creating new markets along the way and uniting a country. Why do you suppose there were no cross-country roads in colonial Africa, only roads into the interior to export resources? Conversely, can you imagine India without its railroads? This was a great article and I just wish, just as we have a worldwide emphasis on all things “green,” we had a worldwide emphasis on better living through infrastructure.