America’s Forgotten 33%

Much has been made of the 1% vs. the 99%; the “super-rich” vs. the rest of us, who are presumably the hard working, loyal Americans who’ve been left behind. But who are the rest of us, and how does who we are affect how much we pay in taxes, and how we may vote?

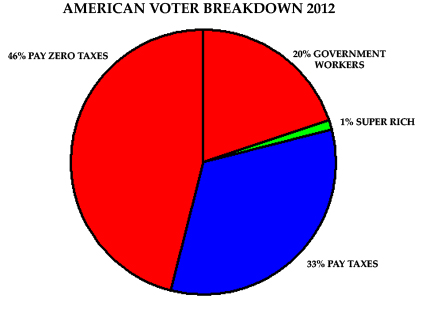

The chart below depicts the American electorate divided not into two groups – the 1% vs. the 99%, but four groups – the 1% super-rich, then 20% representing government workers, 46% representing citizens who either pay zero taxes or negative taxes (ala the “earned income credit”), and the remaining 33% who are neither super-rich, government employees, or not paying taxes. One might term this group the forgotten 33%, because no special interest will speak for them. They have neither the numbers nor the financial wherewithal to decisively influence elections.

The choice of colors – red for the 20% political class AND for the 46% entitlement class, is not accidental. These voters have an identity of interests that automatically inclines them to favor more government spending; government workers because more government spending means more job security, higher pay and benefits, and more expansion of their organizations, and citizens who pay no taxes because their economic status is enhanced through receiving entitlements for which they bear no share of the costs. This identity of interests between the political class and the entitled class has created a supermajority of voters in America who have a self-interest in supporting big-government.

The choice of colors – red for the 20% political class AND for the 46% entitlement class, is not accidental. These voters have an identity of interests that automatically inclines them to favor more government spending; government workers because more government spending means more job security, higher pay and benefits, and more expansion of their organizations, and citizens who pay no taxes because their economic status is enhanced through receiving entitlements for which they bear no share of the costs. This identity of interests between the political class and the entitled class has created a supermajority of voters in America who have a self-interest in supporting big-government.

Perhaps the most appalling – and unchallenged – fallacy promoted by the big-government supermajority, primarily through their spokespersons in the public sector unions, is that the super-rich are “trying to destroy the middle-class by pitting the private sector workers against the public sector workers.” Nothing could be further from the truth.

The middle class can indeed be represented by the 20% of the population who works for the government, combined with the 33% of the population who works in the private sector and make enough money to pay income taxes. But the similarity ends there. Government workers have pay and benefits that are, on average, twice what private sector workers earn. Their pension funds offer defined retirement benefits that are literally five times better, on average, than what private sector workers collect from social security.

While the government worker union spokespersons want us to believe that Wall Street is trying to divide and conquer the middle class by pitting private sector workers against government workers, the truth is this: Government workers have joined with Wall Street and turned against the private sector taxpayers, because it is in their mutual economic interests to do so. Nothing illustrates this fact more clearly than the existence of nearly $4.0 trillion in government employee pension fund assets, paid for by taxpayers, invested and managed by Wall Street, with taxpayers guaranteeing the returns (if the investments fall short, taxes go up), and government workers guaranteed the defined benefit that allows them to retire, on average, 10-15 years earlier than private sector workers, with pensions that average 3-4 times as much money as social security.

The “super-rich” embody, of course, more financial interests than just those of Wall Street bankers. But Wall Street bankers, who used their bipartisan political influence to over-build America’s financial sector and defer any sort of meaningful regulations that might have introduced competition and accountability into their industry, are the ones who most deserve the ire of the American electorate. They are also the ones who are most co-dependent with the political class, because there is no source of money pouring into Wall Street that comes anywhere close to the hundreds of billions each year that taxpayers have to fork over to the public employee pension funds.

To turn around and suggest that somehow the super-rich are aligned with the forgotten 33% – those middle-class private sector workers who make enough to pay taxes – strains credulity. Both the super-rich as individuals and the super-rich to the extent they are associated with corporations or financial institutions are completely bi-partisan in their political contributions. For that matter, Republicans are only scarcely less addicted to big government programs and higher taxes than Democrats. Many of the super-rich are not capitalists in the most virtuous and productive sense of the word – they aren’t trying to altruistically imagine innovations that will make our lives better, then fighting to convince people to voluntarily purchase these products – they are using their political influence to lock out competitors, access government subsidies, and force people to purchase their products through laws and regulations.

Here are reasons why the super-majority of the political class and the entitlement class is unsustainable:

(1) The much higher compensation and benefits for government workers relative to private sector workers, and the nearly unassailable political influence they now wield through their unions, are both factors that have slowly emerged over the past 10-20 years, but never before existed.

(2) Only now are the demographic implications of an aging population (along with recently enhanced retirement benefits for government workers) making a real impact on government budgets.

(3) Medical treatment options are now so effective and expensive that medical spending must legitimately occupy a greater percentage of GDP than historically, and funding this cannot occur if 66% of the population pay no taxes.

(4) The size and extent of government and government regulations are greater than ever, putting additional pressure on the economy.

America’s forgotten 33%, those who are neither entitled to avoid all taxes, nor members of the political class who pay no taxes, nor the super-rich, might be called “The Atlas Generation.” They carry the world on their shoulders. Their challenge is daunting – they must convince the political class to support sustainable taxpayer funded benefits under formulas that apply equally to ALL workers, public or private, without relying on Wall Street speculative investments to pay for this. Equally challenging, they must convince the entitled class that there is an alternative to identity politics, the politics of envy, and the cycle of government dependency. And they must convince a critical mass of the politically influential super-rich to embrace and advocate a political economy that nurtures competition instead of crony capitalism.

Edward Ring is a contributing editor and senior fellow with the California Policy Center, which he co-founded in 2013 and served as its first president. He is also a senior fellow with the Center for American Greatness, and a regular contributor to the California Globe. His work has appeared in the Los Angeles Times, the Wall Street Journal, the Economist, Forbes, and other media outlets.

To help support more content and policy analysis like this, please click here.

Is that the sound of crickets I hear? Has this non-relevant site become even less relevant as hate spews forth from the writers pen? Is it possible that your only remaining fan (Rex) is enough to support your pathetic attempt to steal retirement(s) from those who have earned it? Is it possible to keep turning a blind eye to those who don’t earn a living, but cost tax payers dearly; welfare, illegals, high speed rail worshipers, Rex, and so on. Does the fact that you weren’t able to land that government job really burn you so bad?

I don’t expect the answer to any of these questions (esp the last) as you would have to be honest with your audience, and more importantly – honest with yourself.

ISthat – crickets! Nice touch. Here are two posts that certainly reflect a bit of watching, they address immigration, and bullet train economics, respectively:

https://civicfinance.org/2010/01/31/assessing-immigration-to-america/

https://civicfinance.org/2010/11/10/bullet-train-boondoggles/

Ah, you bring up immigration. Well, here are some facts:

From the L. A. Times

1. 40% of all workers in L. A. County ( L. A. County has 10.2 million people) are working for cash and not paying taxes. This is because they are predominantly illegal immigrants working without a green card.

2. 95% of warrants for murder in Los Angeles are for illegal aliens.

3. 75% of people on the most wanted list in Los Angeles are illegal aliens.

4. Over 2/3 of all births in Los Angeles County are to illegal alien Mexicans on Medi-Cal , whose births were paid for by taxpayers.

5. Nearly 35% of all inmates in California detention centers are Mexican nationals here illegally.

6. Over 300,000 illegal aliens in Los Angeles County are living in Garages.

7. The FBI reports half of all gang members in Los Angeles are most likely illegal aliens from south of the border.

8. Nearly 60% of all occupants of HUD properties are illegal.

9. 21 radio stations in L. A. are Spanish speaking.

10. In L. A. County 5.1 million people speak English, 3.9 million speak Spanish.

(There are 10.2 million people in L. A. County . )

—

But you CHOOSE to attack people who work for a living, rather than address the real tax sucking illegals of the world. You may try to come off as a conservative, but underneath you are a liberal apologist.

Is it possible that your only remaining fan (Rex) is enough to support your pathetic attempt to steal retirement(s) from those who have earned it?

If you’re a gov employee you did not “earn” your 3%@50 [insert multiplier here] $10 million “retirement”, you stole it, ripped it off, jacked it from taxpayers.

I’m living in Europe, and the more (poor) countries that join the European Union, the more problems we import. I guess our leaders want us to look a lot like the USA…