Placentia’s Independent Fire Dept Saves Millions and Improves Service

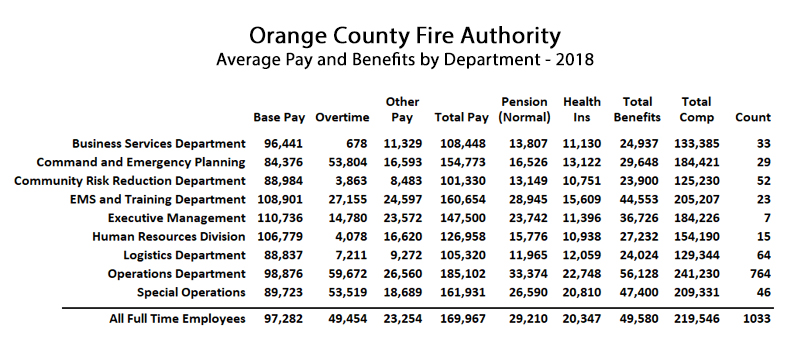

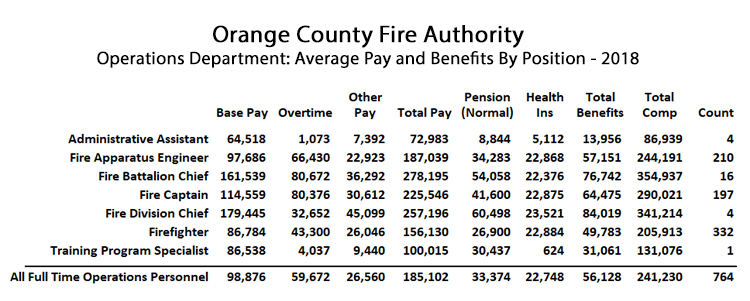

On July 1, 2020, the City of Placentia formally terminated its contract with the Orange County Fire Authority, where the average operations employee in 2018 collected pay and benefits in excess of $241,000. Seeking to create a new model that reduced these unaffordable levels of pay and benefits, as well as made more efficient use of personnel, and despite bitter opposition from the firefighters union, the City Council spent the year prior to July 2020 designing and building an independent fire department.

With over three months of operations now behind them, it is possible to review early results of Placentia’s experiment. According to the city’s “final quarterly update” on Placentia’s Fire and EMS Services, released on October 20th, in their first three months of operation, the new independent fire department serviced 40 percent more daily calls than the prior year with OCFA, reduced local response times by over 3 minutes when compared to OCFA, and reduced the need for mutual aid from neighboring cities by 85 percent.

One of the ways Placentia accomplished this was by using ambulances and paramedic squad units to respond to medical emergencies instead of 55,000 pound fire trucks. To further reduce response times, the city also invested in emergency vehicle traffic signal preemption devices through major intersections. To reduce costs, in addition to relying on ambulances for strictly medical calls, the city contracted with part-time firefighters and fully trained reserve volunteers instead of paying overtime to fill absences and vacancies. The city also replaced the firefighters CalPERS pensions with a 401K plan.

In response, neighboring agencies in Orange County have resisted Placentia’s innovations by not signing automatic mutual aid agreements, an arrangement that is the standard method whereby fire departments with adjacent jurisdictions assist each other. Not only does this allow more firefighting resources to be quickly applied to fires too big for one small department to handle, but more commonly it is the way that the nearest station responds to emergencies regardless of jurisdictional boundaries.

A troubling complication relating to these automatic mutual aid agreements is that even in the case of Fullerton, which did eventually enter into an agreement with Placentia, Fullerton’s fire department is not making full use of the agreement. Reached for comment via email, Placentia’s city manager, Damien Arrula, offered considerable detail on this situation. The next four paragraphs constitute his lengthy response, which merits publishing in its entirety:

“While we have successfully entered into an auto/mutual aid agreement with Fullerton, it doesn’t appear that that agreement is being utilized by the Fullerton Fire Department to its fullest intent. In other words, Placentia’s Fire Department is not being called to assist the residents of Fullerton when we are clearly identified as being closer and available to assist or wherein there’s a need for extra support. In the spirit of the modern fire service, which is known as ‘calls without borders,’ we are supposed to assist residents with the closest available unit with the fastest available response time, regardless of whether they are in Fullerton, Brea, Yorba Linda or Anaheim. This is the system being used throughout Orange County and the nation, and yet it’s not being used locally, to the detriment of the public we took an oath to protect.

What makes this more egregious is that several Chiefs have referred to Placentia as a ‘black hole’ from an operational standpoint. Which translates to ‘don’t call Placentia unless you absolutely have to because we (and our fire unions) don’t like their model.’ This is disturbing behavior from a Command Officer or anyone that is in the business of the fire service.

In OCFA’s case, although their model relies heavily upon auto/mutual aid, OCFA has outright refused to contact Placentia Fire for auto/mutual aid calls. And when they have, they have cancelled those calls very quickly, meaning Placentia never goes into Yorba Linda to assist any more. This is despite the fact that our station on Valencia provided 85% all mutual aid calls between Placentia and Yorba Linda just one year ago to assist Yorba Linda residents. What this translates to is OCFA instead calling Anaheim, Brea and Fullerton for auto/mutual aid, which causes them to leave their cities exposed while they traverse Code 3 all the way through Placentia enroute to a call in Yorba Linda.

This ultimately and undoubtedly has resulted in longer response times by several minutes for the residents of Yorba Linda from just one year ago, all simply because of their refusal to contact us for assistance, nor the other agencies demanding of OCFA to use the system as was intended. When lack of oxygen to the brain for more than four minutes occurs, this can result in brain damage. So when we say minutes count, they do and when anyone, regardless of title, rank or authority plays games with people’s lives, they should be held accountable for such actions or reevaluate the oaths that they took as first responders in protecting people.”

Elected officials in neighboring cities should carefully consider what’s happened in Placentia. According to evidence gathered so far, they have saved money, they have improved service, and in response, neighboring fire departments have incurred increased costs and endangered lives as a consequence of their resistance to Placentia’s innovations. Given these successes, elected officials not only near Placentia but throughout California should carefully consider what’s happened in Placentia.

In evaluating how Placentia’s model might be emulated in other cities and counties in California, local elected officials should recognize there are two very distinct avenues of innovation. One involves exchanging defined benefit pensions for 401K plans, which is a significant source of savings. When Placentia took their firefighters out of CalPERS, the union controlled state legislature responded by passing AB 2967, which forbids agencies from exempting employees from CalPERS contracts. But that law does not take effect until January 2021, and it may be possible that CalPERS client agencies can preserve their rights to opt out of CalPERS in the future if, before December 31, 2020, they submit a notice to CalPERS that they intend at some point in the future to provide services using new classes of city employees.

The significance of this should not be understated, because it isn’t just fire departments that could be affected. The CalPERS system, along with most of California’s state and local government employee pension plans, continues to increase its required annual contributions from employers. But if these employers preserve their right to eventually reclassify city employees out of the CalPERS system, from firefighters to sanitation workers, there is a chance they could avoid being financially swamped in the future. On the other hand, statewide, systemic reforms to California’s public employee pensions is still a possibility. But meanwhile, local governments should have their attorneys investigate the fine print in AB 2967. Simply sending a letter to CalPERS by 12/31 might save millions in the future.

Regardless of whether or not cities and counties can get their pension costs under control, however, they must recognize the many additional innovations that saved money while improving the quality of service for Placentia’s new fire department. In a three part report published by the California Policy Center earlier this year (part one, part two, part three), Placentia’s many operational changes are described in more detail. To summarize two of the highlights, by using a contract ambulance service and by getting overtime costs under control with part-time and volunteer firefighters, Placentia has logged savings comparable to those savings realized by opting out of CalPERS.

In this time when government officials and vocal activists continually remind us all of the opportunity that the COVID-19 pandemic offers for a complete societal “reset,” it is interesting to wonder why such grand reset plans aren’t being extended to the rules and procedures and operational models that govern the public sector.

California’s firefighters, along with all public servants in California, are urged to look at innovations such as what Placentia has done, and recognize that these paradigm shifts are being attempted in the interests of all of California’s citizens, during difficult times. They should use their considerable political clout to offer mutual aid in support of this process.

This article originally appeared in the California Globe.

* * *

Edward Ring is a contributing editor and senior fellow with the California Policy Center, which he co-founded in 2013 and served as its first president. He is also a senior fellow with the Center for American Greatness, and a regular contributor to the California Globe. His work has appeared in the Los Angeles Times, the Wall Street Journal, the Economist, Forbes, and other media outlets.

To help support more content and policy analysis like this, please click here.